Amid all the SI talk of wobbling societal dominoes, it feels like another one might just have wobbled too far this week. All thanks to millions of amateur traders working together to take on some of Wall Street’s most sophisticated investors — and, for the moment at least, winning. Propelled by a mix of greed and boredom, gleefully determined to teach Wall Street a lesson, and turbocharged by an endless flow of get-rich-quick hype and ideas delivered via social media, these investors have piled into trades around several companies, pushing their stock prices to stratospheric levels.

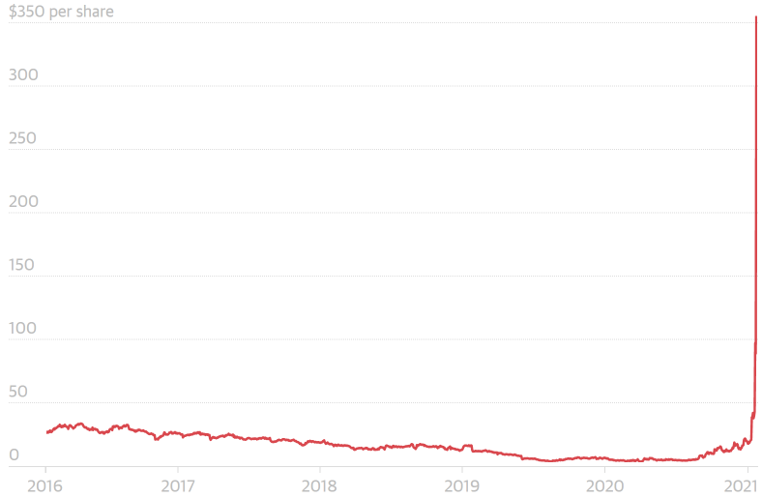

Some of the names are from an earlier business era. BlackBerry’s shares are up nearly 280 percent this year. Stock in AMC, the movie theater chain, has surged nearly 840 percent. But the trade that captures the David-versus-Goliath nature of the moment involves GameStop, the troubled video game retailer that was once a fixture in suburban malls.

On Wall Street, individual investors are often derided as ‘dumb money’, destined to lose against the highly compensated analysts and traders who buy and sell stocks for a living. But in recent days, individual investors — many of them followers of a popular, juvenile, foul-mouthed Reddit page called Wall Street Bets — have upended that narrative by banding together to put the squeeze on at least two hedge funds that had bet GameStop’s shares would fall. At the time of writing, GameStop’s share price is already up 1700% and, thanks to the fact that the game has created a ‘virtuous cycle’, looks set to continue rising high enough to send the two hedge-funds to the wall.

I’ve never been a great fan of the stock market, but very definitely at the evil end of the morality spectrum, it seemed to me, were those organisations that sought to earn their way in life by betting on the poor fortunes of others. Worse yet, organisations whose actions wittingly served to accelerate the poor fortune of others.

And so it feels more than fair that when a domino falls it falls squarely on those responsible for the shorting-evil.

Looked at from a contradiction solving perspective, a desire to destroy these short-focused funds has traditionally been prevented by the fact that Wall Street looks after its own. From a Business Matrix perspective, this situation can be generalised as a Support Risk versus Support Capability conflict. The four most frequent ways to resolve such conflicts are currently:

Principle 13, The Other Way Around

Principle 10, Preliminary Action

Principle 4, Asymmetry

Principle 35, Parameter Change

All of which point quite astutely to the still unfolding GameStop situation. A handful of Financial Elites outdone by (Principle 4) millions of ‘dumb’ (Principle 13) investors, who got together online (Principle 35) and worked out a (Principle 10) work-together plan.

Extrapolating just a little, the 99% seem to have unlocked a peaceful and potent way to disrupt the invulnerable ‘1%’. Social Media might already be responsible for destroying democracy. Now, if the momentum is allowed to continue building it might just be on its way to doing the same for capitalism. Or, at the very least, establishing a ‘virtuous cycle’ that will see the end of the shorters.

How will it all end? Probably badly. The bigger the balloon, the louder the pop. And, thanks to being bailed out in the GFC, and being artificially pumped up by Quantitative Easing fake money ever since, the Wall Street balloon has become the biggest in mankind’s history.

#EatTheRich.