More and more people seem to be coming to the conclusion that The Sovereign Individual book has played a significant behind-the-scenes role in the way the Brexit story has played out (https://alastaircampbell.org/2020/12/the-brexit-revolutionaries-have-barely-begun-britain-needs-to-wake-up-fast/). At the very least, the book does much to explain some of the more counter-intuitive moves of those implementing the strategy. In that sense it has much in common with other late-period Capitalist thinking. The most recent of which to cross my radar came from the (notorious?) Babson College, its commercial offshoot, Babson Global, and its Babson Global Competitiveness and Enterprise Development Project. Which, Babson Global CEO, Shahid Ansari has said, ‘gives us another powerful tool to use entrepreneurial thought and action to address the economic and social problems facing the world and allow individuals and societies to thrive and prosper during these challenging economic times’.

Going a step further, “There is simply no greater challenge faced by mankind than helping to lift people out of poverty and frame a world of abundance, and not of scarcity,” said Shanker Singham, Managing Director of the CED Project. “By leveraging the forces of the competitive market system, as opposed to relying on aid, the Babson Global Competitiveness and Enterprise Development Project seeks to identify new ways of delivering economic growth to countries around the world.”

The Babson worldview represents classic Gravesian, ER, Orange thinking. Which looks at a DQ, Blue world of fairness and use of state-aid to ‘help’ those at the bottom of society and concludes that such things fundamentally don’t work. And that they don’t work for two reasons. Firstly, at an individual level, they create a state of ‘learned helplessness’ that serves only to perpetuate the need for more state-aid. Secondly, at a state level, comes comes a recognition that aid comes with an inherent level of inertia, which in turn provokes corruption. At first, the competition that capitalism sparks will very likely achieve what Babson Global is trying to achieve. The key phrase being, ‘at first’. The problem being that sooner or later the fundamental law of the s-curve kicks in. In the first half of a capitalism s-curve, we see what might be thought of as the sort of ‘good capitalism’ the Babson Enterprise Project is trying to spark. In the second half, however, when the law of diminishing returns kicks in, good capitalism turns inherently bad. It’s one thing to introduce the developing world into this new world of capitalism, but, sadly, most parts of the developed world are already well into the bad second-half of the curve. A second half that means, fundamental human nature being what it is, capitalists start their own version of cheating and corrupting the system. This cheating, unlike the DQ version, usually comes in the form of ‘externalisation’. Businesses that produce toxic side-effects try and hide them. The gig economy – probably the definitive manifestation of bad-capitalism – tricks individuals into believing they’ve been offered ‘freedom’, when in fact they’ve been turned into little more than indentured slaves. Anything that can’t be measured or generates problems that only become apparent in the long term (oestrogen-based pesticides for example) becomes grist to the short-termist bad-capitalist mill. Failing to be able to sensibly measure things like ‘quality of life’, adverse effect on mental health, etc mean they become candidates for more externalisation.

So much for global fundamentals. The answer to such top-of-s-curve challenges, however, is not to regress to the previous s-curve. Solving ER’s bad-capitalism, in other words, doesn’t happen by reverting to DQ’s bad fairness. That’s basically what was attempted in the aftermath of the GFC. The capitalists demonstrated that de-regulation gave them the perfect opportunity to ‘externalise’ a whole bunch of things they shouldn’t have been allowed to externalise. But trying to fix the problem by creating a mountain of new (Sarbanes-Oxley, DQ) regulation merely created a worst-of-both-worlds solution. Far better would have been solving the ER and bad-capitalism contradictions and ‘breaking through’ to the next s-curve.

Perhaps the Babson work, much as it betrays their abject lack of understanding of s-curves as they might apply to societal progress, does make some kind of attempt to distill the world down to first principles. At least in a Newtonian sense.

Here is Shanker Singham’s capitalist version of Newton’s Laws:

- Wealth can be created or destroyed.

- Wealth is easier to destroy than create

- Competition is the greatest force for liberating wealth-creating forces

If we now bring the idea of societal s-curves into this story, we might speculate that the next s-curve after DQ’s Order and ER’s Competition, has to be FS’s ‘communitarian’ paradigm. There’s no rule at this point that says the structure of any first principles of an FS-lead society have to follow the same structure as Singham’s reframing of Newton. But we do know that the FS world-view is still one that does not fully understand the innate complexities of the world. i.e. the FS world is also a Newtonian world. That knowledge, then, might cause us to at least start with a hypothesis that Singham’s structure makes for a valid set of FS-based first principles. Here’s what I think they translate to:

- Meaning can be created or destroyed.

- Meaning is easier to destroy than create.

- xxx is the greatest force for liberating meaning-creating forces.

The first idea being that in the FS Communitarian world, ‘meaning’ supplants Capitalist ER’s ‘wealth’.

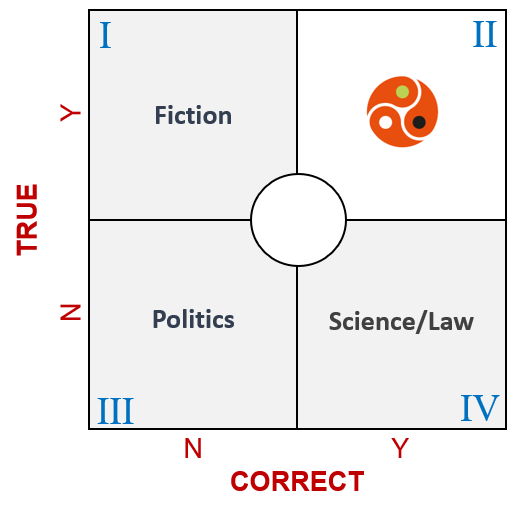

Which then just leaves the question of xxx. Competition is to wealth as xxx is to meaning. Answer? Xxx is truth. Or, more accurately, the ‘true and correct’ second Quadrant of this 2×2…

…One we’ve been using quite bit these past few months. Maybe now we’re beginning to understand why?