Weak signals. One. A friend was talking to an estate agent in rural Wales about the number of ‘sold’ signs, and was told that everything has been bought up by English city-dwellers over the summer. Two. Things are exactly the same here in North Devon. A friend recently put their house on the market and sold it within three days.

There are always winners in a crisis. On the evidence of these weak signals, what is becoming clear is that some of the biggest winners so far are those with money. Rent-seekers who have been given billions of pounds by the government – quite likely the biggest transfer of money to the already-rich ever in history – and are now looking to invest in more properties they can rent out. It beats working for a living I guess.

What it also means is money that by rights ought to be heading in the direction of crisis-solving innovation projects is instead heading in the direction of ‘safe’ property investments. Investments that – tragically – only serve to make the overall crisis worse.

This is not an unexpected phenomenon. Neither is the fact that it will end badly for all concerned. Rich included.

We’ve been saying since the start of (the first) pandemic lockdown that we shouldn’t expect the real surge of innovation until the ‘Disillusionment Phase’ of the Disaster Cycle kicks in. Today, we’re still very clearly in the preceding ‘Honeymoon Phase’ of the cycle. Although, granted, unless you’re a lauded frontline worker or cash-rich rent-seeker, it probably doesn’t feel too honeymoon-like any more for the majority. Expediency is rarely a sustainable trait.

Which then perhaps begs the question – especially if you live in Innovaton World like we do – when does the expected innovation tsunami start?

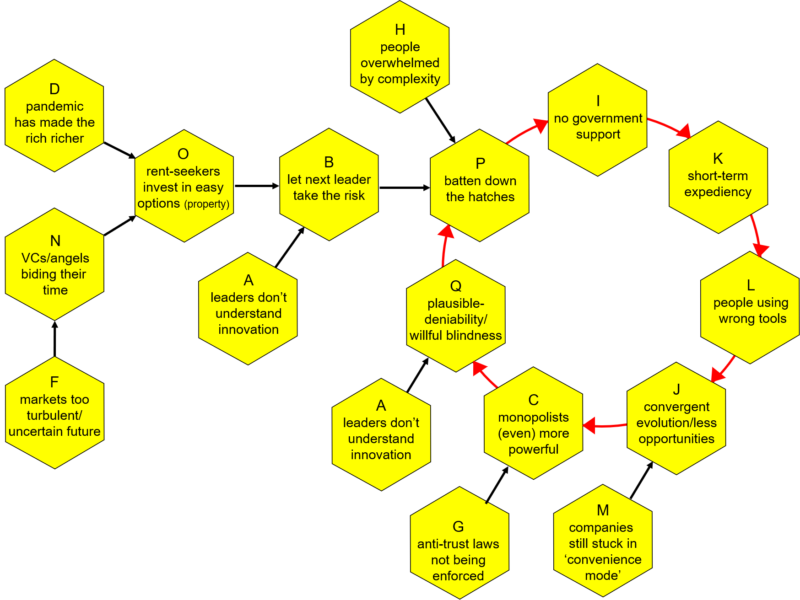

It felt like time for a Perception Map. One that started with the question, ‘innovation isn’t happening yet because…?’

Here’s the resulting Map:

The vicious cycle creating the logjam looks like a particularly vicious one. One that doesn’t look like ending any time in the next six months if I’m being honest. Especially not in the UK, where I think we need the next two economic dominoes to fall over before people properly wake up. In theory, the ‘easiest’ place to break the cycle comes from Government support. Here in the UK I guess we’re starting to see the first tiny steps in the right direction. The first round of disaster-mitigation Government funding was a pure expediency play to furlough people and allow them to pay their rent to the already rich. The second round, announced by the Chancellor yesterday, looks like a move to force employers to contribute more. Which in turn likely means that there will be a brutal cull of jobs in the last quarter of the year. In theory, the move is supposed to remove meaningless, bullshit jobs, but in practice, I fear it will end up eliminating a lot of essential-but-low-paid jobs and in so doing cause a lot of lose-lose suffering. I hope I’m wrong. Right or wrong, though, it’s – again ‘in theory’ – a step towards supporting the flow of money into innovation… if only because when people have nothing to lose, it’s much easier to decide to innovate your way out of the mess you’re in. All in all, though, it feels like a fairly long-winded way of getting the money to where its needed. The rent-seekers, as we’re seeing here in rural Devon, can only be trusted to indulge in more low-risk rent-seeking.

There’s little value in speculating on ‘if only’ hypotheticals, but, its difficult to avoid wondering whether, if the Chancellor had given the first £400B to sparking innovation rather than giving it to rich people, the economy might now be on the way up again rather than in a steep descent, teetering on the edge of an all-out tailspin. Which, I guess, is a way of saying, ‘buckle-up, we’re in for a rough ride’.